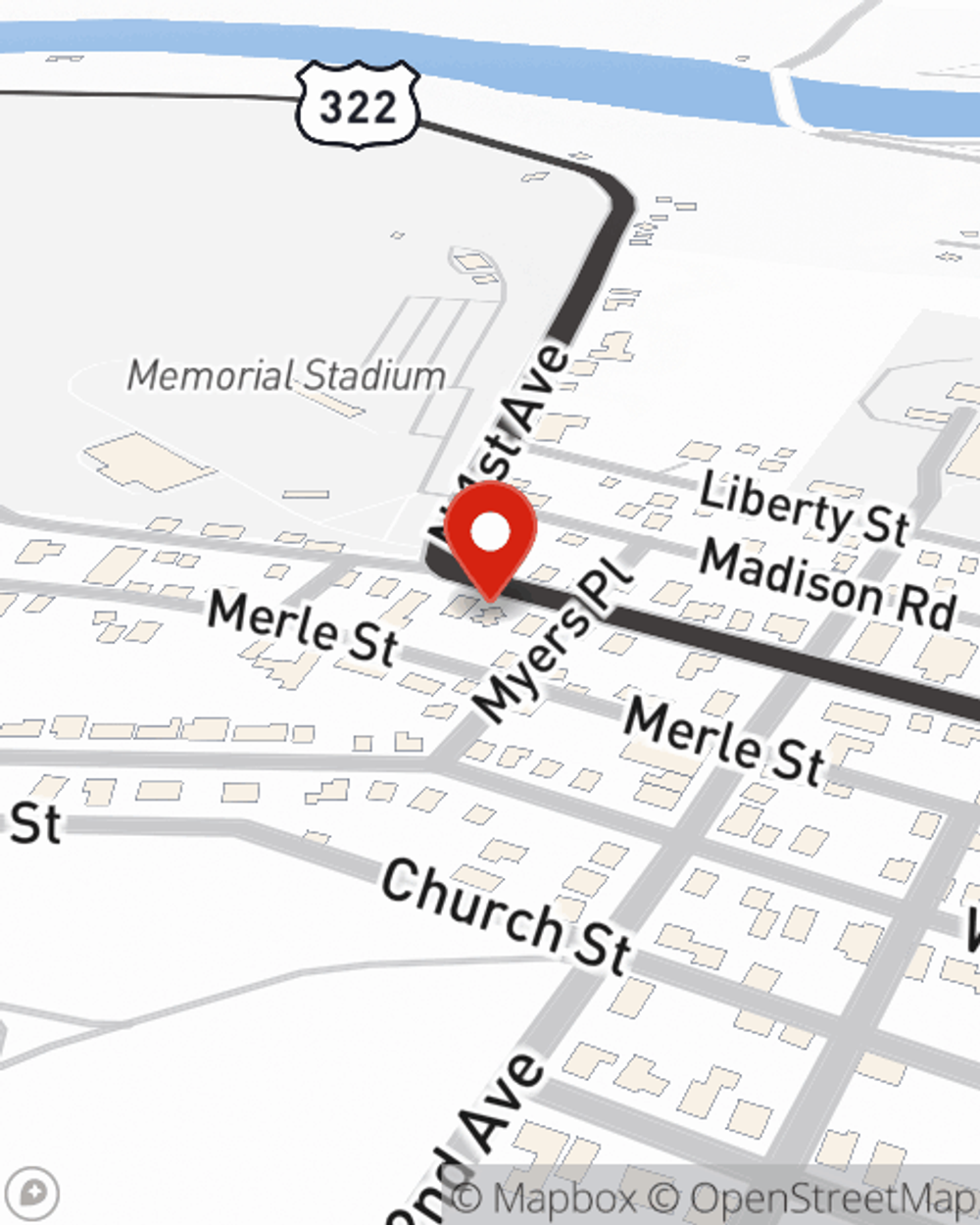

Life Insurance in and around Clarion

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

Be There For Your Loved Ones

It can be a big responsibility to provide for your loved ones, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that those closest to you can maintain a current standard of living and/or pay off debts as they mourn your loss.

Coverage for your loved ones' sake

Life happens. Don't wait.

Life Insurance You Can Trust

And State Farm Agent Jamie Thompson is ready to help design a policy to meet you specific needs, whether you want level or flexible payments with coverage designed to last a lifetime or coverage for a specific time frame. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

State Farm offers a great option for anyone who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can come in handy by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For help with all your life insurance needs, contact Jamie Thompson, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Jamie at (814) 226-5463 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.

Jamie Thompson

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.